Chris Marino – My Introduction to Life Settlements

By Chris Marino , Business Development Director for Toropoint Financial

Hi, Chris here. As a first blog, I wanted to quickly introduce myself. During my 15 years of experience in the Life Insurance industry, I have a lot of experience with the hardships that come with owning a life insurance policy. Mainly, referring to clients who have lapsing policies due to either outgrowing their policies or simply, just not being able to afford the premiums anymore.This led me to wanting to find a solution for my clients. This is when I initially learned about the life settlement industry and realized that I need to learn more.

When I first came across the life settlement industry, I was unsure of what to think about it, as it was a different concept from anything I had previously heard about. However, as I dove deeper into the settlement world, it started to understand how I could provide this as a solution to my clients that outgrew their need for their current policy.

The most important truth I learned was that 90+% of all life insurance policies lapse. In short, 90% of the time the death benefit associated with a life insurance policy is never paid out by the carrier. Reasons policies lapse include; clients outgrowing their initial need for a policy other times, they simply can’t afford to pay the premiums after retirement.

The second truth I learned is that most, if not all, universal life policies generally have an increasing premium as the policy age increases in other words, spiking the cost of the premiums as the policy ages. Basically this means, clients are paying a higher premium in their 70s and 80s than they were during their 50s or 60s with the same policy.

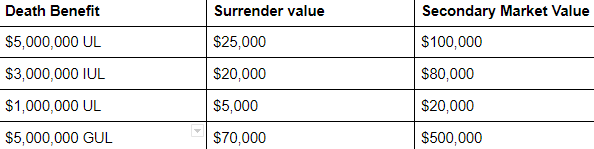

If you can no longer pay premium, you can surrender your policy through the insurance company, and by getting pennies on the dollar and in return, you forfeit your ability to receive the death benefit. Though this is a solution, I never felt it was fair to a client who has spent tens of thousands of dollars in premiums over many years, to simply give up their policy for almost nothing in return. This is where I realized I could offer my clients the opportunity to collect 3-5 times the amount a carrier would provide a policy owner through the life settlement marketplace. Here’s a chart with examples of the life settlement marketplace in work:

Through the life settlement marketplace, I was able to find institutions and private investors who will determine the secondary market value by bidding against each other. Investors range from banks, pension funds, private equity firms, and other institutions. A big benefit of the secondary market is how transparent the entire process is. All these factors led me to understand how impactful a life settlement offer can be to a client.

There’s no restrictions on the types of policies you’re able to trade in the life settlement market which allows for buying or selling of term, Whole life, Universal life, Variable life, Guaranteed life, and Indexed universal life policies. Want to learn more about how Toropoint can assist you in finding a buyer for your unwanted policy? Call us at 1-888-LIFE-757 to chat and see if we can get your 3-5 times more on your policy. Just ask for Chris!

Posted in:

Leave a Reply

Your email address will not be published. Required fields are marked *

Leave a Reply

We will get back to you as soon as possible.

Please try again later.

RECENT POSTS

RECENT COMMENTS

ARCHIVES

CATEGORIES

META

ALL RIGHTS RESERVED© TOROPOINT 2024